MSIF to manage Mersey Metro Mayor’s £20m business growth fund

Flexible Growth Fund is open to any business in the city region that is undertaking a growth project and is part of Steve Rotheram’s £75m Business Growth Package. Tony McDonough reports

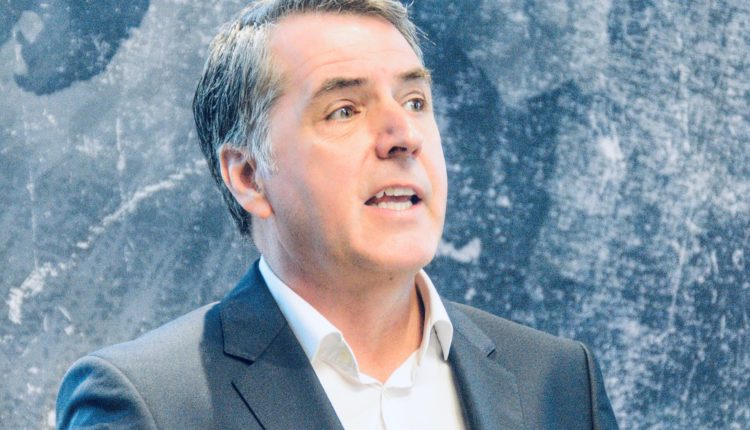

Business loan and equity provider MSIF is to manager a £20m business growth fund launched by Liverpool City Region Metro Mayor Steve Rotheram.

The Flexible Growth Fund is open to any business in the city region that is undertaking a growth project. It is part of Mayor Rotheram’s £75m Business Growth Package, which he claims is the largest set of business support funds seen in decades.

It aims to generate new jobs in the city region, remove obstacles to business expansion, and enable a new generation of ‘change-makers’ that will set Liverpool city region up for long-term growth.

Liverpool-based MSIF was established in 1994 using money from the EU’s Objective One programme and was tasked with providing loan and equity capital for SMEs in Merseyside. Thanks to returns on its investments the organisation has become self-sustaining.

Mr Rotheram will officially launch the Flexible Growth Fund at a special event at the end of January where he and representatives from MSIF, will talk more about the initiative to support local SMEs.

The fund will be distributed in the form of flexible, low-interest loans, that can be accessed quickly and easily by businesses within six to eight weeks. Its model is designed to provide fast access to finance, removing bottlenecks to unlock existing investment opportunities and leverage private sector investment in job-creating and job-sustaining projects.

Loan repayments will be recycled back into the fund, providing new loan capital. This ‘evergreen’ model of fund recycling is a creative method of maximising fund values, making the money work much harder than a traditional ‘one way’ grant fund model where funds can be exhausted quickly.

It looks to address a growing problem for businesses looking to obtain growth finance from traditional sources such as banks and other commercial lenders. This inability or unwillingness to invest has an adverse impact on both the competitiveness of individual businesses, and the productivity of the economy as a whole.

Paul Humphray, investment director at MSIF, said: “There is a definite gap in terms of provision from commercial lenders with businesses discouraged from following this option for many reasons.

“We’ve designed the Flexible Growth Fund to be as fast and as simple as possible to administer, and we’re sure our business community will take advantage. What’s more, the region will benefit from the recycling of funds, meaning we are making the money work as hard as possible for the city region to support long term growth.”

Mr Rotheram added: “This fund is very much about the here and now. I know how difficult it can be making investment decisions in a business. When you add to that the responsibility we have to support our region’s businesses, the purpose behind the Flexible Growth Fund becomes clear.”

It is expected that the first loans from the fund will be made in the first quarter of this year. For more information contact in**@*****co.uk or click here.