Airbus, which has slashed its Deeside workforce by a third to 4,000, will compete with Boeing for a multi-billion pound deal to build 160 aircraft for one of the world’s biggest airlines. Tony McDonough reports

Planemaker Airbus is competing with US rival Boeing for a multi-billion pound deal to build 160 new aircraft for Air France KLM.

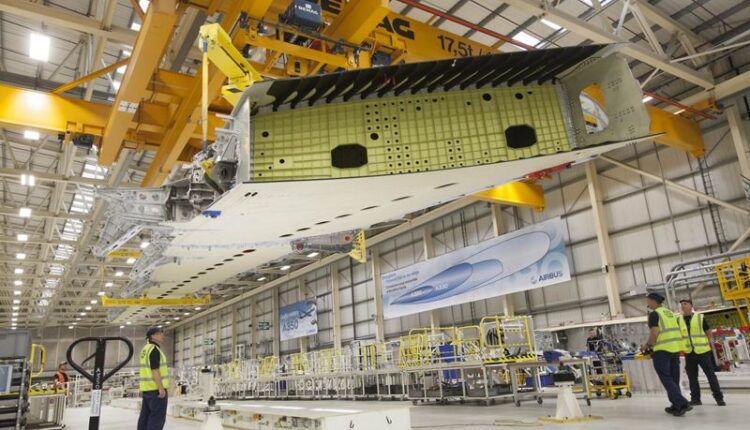

A deal of that size would be welcome news for the workforce at the giant Airbus wing-making plant at Broughton near Chester. The devastating impact of the COVID-19 pandemic on the aviation sector has seen headcount at the site slashed from 6,000 to 4,000.

Negotiations between the company and unions ensured there were no compulsory redundancies from the factory. But last year, Airbus chief executive Guillaume Faury said the company was facing “the gravest crisis this industry has ever experienced”.

At the end off June US carrier United Airlines agreed a deal to buy 70 Airbus A321 aircraft to add to an existing order for 50 A321XLR aircraft. It brings the total commitment from the airline to 120 A321 aircraft.

Airbus chief commercial officer, Christian Scherer, said of that deal: “Such a significant order from a great airline like United underscores that the A321neo offers unmatched capabilities, operating economics, and passenger friendliness.

“No other aircraft can do what the A321neo can do, and the Airbus team is most gratified by United’s strong affirmation of its premium status. The A321neo will complement United’s future A321XLR aircraft, together creating a privileged segment on its own.”

Airbus is not commenting on the possible Air France KLM deal but Bloomberg reports the airline has already started negotiations with both Airbus and Boeing over a possible deal. The report says the carrier is keen to expand its low-cost operations with the purchase of 160 single-aisle planes.

That would mean a choice between the Boeing’s 737 Max and Airbus’s A320neo-series narrow-bodies. Air France KLM’s fleet at Transavia, which has French and Dutch divisions, comprises mostly 737-800s.

According to the Bloomberg report Air France-KLM chief executive Ben Smith has made the expansion of low-cost operations a key element of plans to rebound from the COVID-19 crisis.