Football Pools secures £14.5m cash injection

Now in its 100th season the operator of The Football Pools in Liverpool has refinanced its debts as it reports annual losses of more than £5m. Tony McDonough reports

Liverpool-based The Football Pools has secured a £14.5m refinancing of the business which will celebrate its 100th anniversary in 2023.

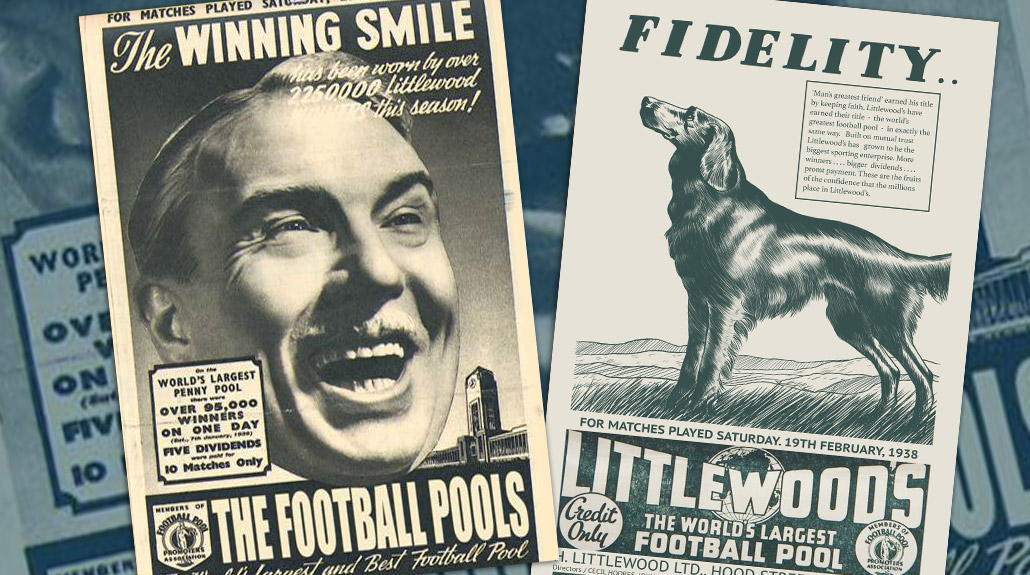

Based in Walton in Liverpool, the Pools was founded in the city in 1923 by tycoon Sir John Moores. Then called Littlewoods Pools it was regarded as the best way of getting rich quickly by generations of Brits.

Today it is a business that has taken the traditional pools game and updated it for the digital age. The company, which employs more than 150 people, is now in its 100th football season. In August it signed up former Liverpool, Real Madrid and Manchester United striker Michael Owen to be the face of The Football Pools.

In its latest accounts published on Companies House, The Football Pools is reporting revenues of £26.2m for the year to December 31, 2021. This is slightly up from the £25.9m reported a year earlier.

Its pre-tax losses widened to £5.2m from £4.8m during the 12-month period. It says this loss reflected the high finance charges. At an operating level the company is profitable, reporting a surplus for the year of just over £1m.

In 2017 The Football Pools secured lending of £35m from CVC and NatWest. In July this year the business replaced £18m of debt owed to both institutions with £9m of new debt with Hoplon Investment Partners. Shareholders have also injected a further £6.5m into the company.

In February 1923 John Moores (later ‘Sir John’), along with business partners Colin Askham and Bill Hughes, distributed the first 4,000 football pools coupons from an office in Liverpool.

Players had to use their skill and judgement, or just blind luck, to forecast Saturday’s football results. Other companies joined the market in the 1920s including Zetters and Vernons Pools, also based in Liverpool.

By the 1960s around 14m people played every week in the hope of getting rich. In 1994 the National Lottery was launched and the number of people playing the game declined sharply. Few believed the pools would survive. However, a hard core of players stayed loyal.

Littlewoods Group sold its pools operation to Sportech for £160m in 2000. Sportech later acquired Vernons from Ladbrokes and Zetters. In 2008 it brought them under one brand – The Football Pools. In 2017 Sportech sold the Pools to FP Acquisitions in an £83m deal.

Still owned by FP, it is run by two directors – chief executive Derek Lloyd and chief financial officer Carl Lynn. In an interview in 2018 Derek spoke about the nostalgic appeal of the pools. He said: “The Football Pools were an integral part of family life.

“People remember it fondly because it used to be the reason why family’s got together, whether it be the younger members colouring in those little coupons or alternatively everyone gathering around to discuss results.”

Although the game has still seen some decline in the number of players, directors are confident they can stabilise the subscriber base and grow the numbers once again. The pools generates more than £20m of annual revenues. Almost £6m is generated by a sports betting and online casino operation.

In the annual report the business says: “The company has continued its investment strategy in marketing technology with the aim of stabilising and growing the Football Pools and lottery betting subscriber base of customers while investing in the new digital channels to attract a new audience of customers.

“The board has taken steps to mitigate the threat posed to the business by the historic decline in football pools customer numbers under the previous ownership. These include investing more resources to recruit new players and retain existing players.”

The Football Pools is using third-party agencies to recruit new players and expanding revenue channels to allow customers greater choice of how they play. It aims to continue converting existing players from card and cheque to direct debit.

According to the accounts the business had cash balances of more than £5m at the end of 2021. They also reveal the two directors were paid a total of £405,000 during the year with the highest paid of the two receiving £235,000.