Furnace issues hit revenues at Surface Transforms

CEO voices frustration as production issues hold back revenue growth at Liverpool city region supercar brake disc maker Surface Transforms. Tony McDonough reports

Knowsley brake disc maker Surface Transforms (ST) is reporting full-year revenues of £5.1m for 2022 – 113% up on 2021 but lower than originally forecast.

This was due to what it called “highly specific, but cumulatively significant” production issues with furnaces at the factory in late November and December as volumes were ramped up.

These problem furnaces are now operational but management wishes to see several weeks of consistent output before being comfortable to confirm that the issue has been permanently resolved.

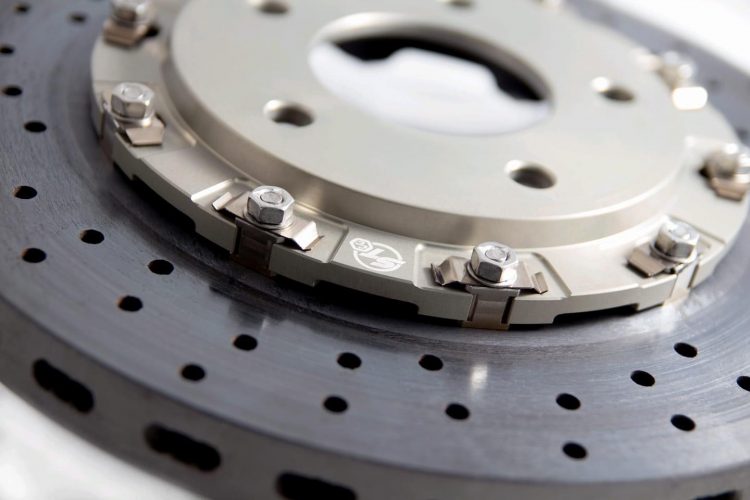

ST manufactures carbon ceramic brake discs for a number of high performance cars. Customers have included Porsche, Ferrari and Nissan. It is currently supplying brake discs for the Aston Martin Valkyrie which retails at £3m.

In November the company, which is listed on the Alternative Investment Market, announced it had won a £100m deal with an unnamed US automotive giant. It is the biggest contract in the firm’s history and takes its order book close to £300m.

However, the latest production issues have left ST chief executive Kevin Johnson frustrated. He said: “It is most frustrating to again be reporting a production problem impacting our previous guidance.

“The core issue is not the technical problems themselves, but the lack of capacity to provide headroom when they occur. Technical problems are part of the learning curve arising from a tenfold increase in production rates.

“The key is to ensure that we have spare capacity to recover the lost production after the problem has been solved.

“The installation of Phase 2 capacity by the second quarter will enable the company to get ahead of the continuingly strong customer demand and then, with completion of Phases 3.1 and 3.2 capacity increases in the following two years, to stay there.”

While the company was profitable in November, the production issues resulted in the business not being profitable in December.

ST repeated its statement made on November 24 that it expects the planned Phase 2 doubling in capacity to £50m sales a year to be operational in the second quarter of this year.

Implementation of Phase 3.1 capacity increase to £75m a year sales is also on track, with more than £3m of equipment orders placed since its fundraising efforts last year and the remainder of the project at advanced stages of commercial discussions.

Despite the latest setbacks ST is not changing its guidance for 2023 when it will expect to move into profit. It will reveal full-year results for 2022 in April.