Latest Big Nine office market report from Avison Young shows grade A office supply in Liverpool has plummeted with headline rents too low to incentivise new build. Tony McDonough reports

Availability of grade A office space in Liverpool city centre has hit a critical low with prospects of new development in the commercial core looking doubtful.

According to the latest quarterly Big Nine survey from Avision Young (an analysis of the top nine regional office markets outside of London) grade A space across the city region has now fell to a quarter of its 2014 peak.

Office take-up in Liverpool during the second quarter of 2021 amounted to 50,297 sq ft in the city centre and 23,277 out-of-town, which overall was 43% down on the 10-year average, Avison Young said.

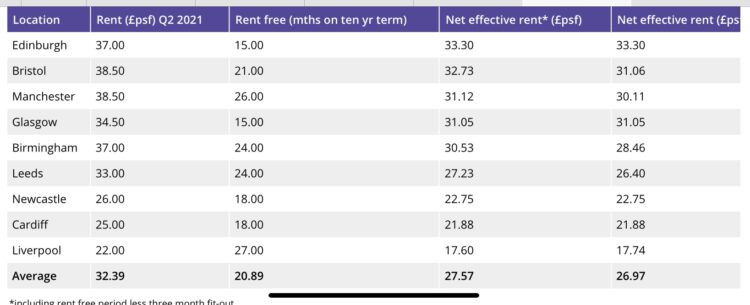

Grade A headline rent in Liverpool is anchored at £22 per sq ft. This puts the city at the bottom of the league table. It is £3 behind Cardiff which can command £25 per sq ft, more than £10 below the Big Nine average of £32.39 per sq ft and way behind Manchester where headline rents are £38.50 per sq ft.

Headline rents are an important factor when it comes to incentivising investors and developers. If the rental returns are too low then new build is unlikely to happen without gap funding, or a pre-let. St Paul’s Square, the last major development in Liverpool’s commercial district, only went ahead thanks to European funding.

Kier and CTP were in talks with telecommunications giant BT prior to the pandemic with a view to taking 80,000 sq ft of space at the proposed £200m Pall Mall development. However, the pandemic forced BT to rethink its plans and put any deal on hold. This casts a cloud of uncertainty over the Pall Mall project.

On the brighter side there is 60,000 sq ft of grade A space available on the other side of the city centre at The Spine at Paddington Village, located in the city’s Knowledge Quarter. The Royal College of Physicians and Clatterbridge Cancer Centre have taken more than 70,000 sq ft in the building in pre-let deals.

There is also space coming out of the ground across the river in Birkenhead. Work is well under way on Hythe, a 25,000 sq ft office development in Wirral Waters by Peel L&P. It will provide smaller units for SMEs and is being backed by Merseyside Pension Fund and the Liverpool City Region Combined Authority.

And building A2, a 58,000 sq ft development in Birkenhead town centre, which is currently in for planning, will also help to bring more space to the market should it be approved by committee later this summer. It will not complete until at least mid-2023.

There are a number of active requirements in the local market, the largest of which are Pinnacle (10,000-15,000 sq ft), LJMU (20,000-35,000 sq ft) and Orega (20,000-30,000 sq ft).

Ian Steele, Principal at Avison Young in Liverpool, said: “The increasing shortage of good quality office space in the Liverpool city region has been part of a huge debate in the market over recent years.

“While it’s encouraging to see developments such as The Spine reaching completion, it is critical that solutions are found so that more new space is delivered to the market to ensure that the city region is able to compete with other regional centres to try and attract high calibre occupiers.

“Understandably, there has been a slow-down in both demand and transactional activity throughout the year to date, but interestingly at the end of Q2, according to Avison Young’s UK Cities Recovery Index, Liverpool’s Return to Office Index experienced the strongest growth of 2021 so far.

“This demonstrates that there is growing demand from employees and employers alike to now start spending more time back in the office. With a number of large requirements currently live in the market, we expect this slow return to normality to act as a catalyst to reenergising those searches.”

Avison Young’s Big Nine report covers Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds, Liverpool, Manchester and Newcastle. Click here to read the full report.