Latest analysis from Avison Young says the Liverpool city centre office market is ‘severely undersupplied’ with quality space with delays to one major project set to worsen the crisis. Tony McDonough reports

Liverpool’s commercial district is “severely undersupplied” with good quality office space and delays to a major refurbishment project is set to make the situation worse.

For the past few years the city has seen a sharp fall in the availability of grade A or high quality refurbished office space in the central business district (CBD).

There has been no significant volumes of grade A space brought onto the market since the completion of the St Paul’s Square development more than a decade ago.

A key issue in Liverpool is headline rents which have now been stuck at £25.50 per sq ft for more than a year. This is the second-lowest headline rent out of the nine biggest UK regional office markets outside London.

According to the latest Big Nine survey from Avison Young, covering the final quarter of 2023, headline rents in Manchester are £43 per sq ft, in Bristol £42.50 per sq ft, Newcastle £32 and Leeds £37. Only Cardiff is behind Liverpool at £25 per sq ft.

This figure matters to funders of office schemes because it offers a measure of a return on investment. If headline rents are too low then there is little incentive to build speculatively.

One agent told LBN last year that Liverpool rents would have to hit around £28 per sq ft to make building new space an attractive proposition. The only other way a development gets done is with a significant pre-let or with state gap funding.

Good quality refurbished space can help meet demand. The most significant project in recent months has been the upgrade of 50,000 sq ft of space 1 St Paul’s Square, overseen by CBRE.

There have also been refurbishments at No 10 and No 12 at Princes Dock and Liverpool Waters as well as work on No 1 Old Hall Street by Downing. A lot of hopes have been pinned on the major refurbishment of Martins Bank Building in Water Street.

Originally due for completion in 2024, London developer Kinrise revealed the site would be home to community-focused spaces, hospitality outlets and 95,000 sq ft of office space, offering floorplates of up to 17,500 sq ft.

However, earlier this year LBN revealed that Kinrise was pulling out, leaving its joint venture partner, London-based property investment outfit Karrev, in sole charge of the development. This has seen the project stall.

Media outlet Place North West reported in February that Karrev was shortly to put out a tender to find a contractor to take on the work. However, Karrev itself has yet to comment. The company apparently has no website nor listed telephone number.

Big Nine publisher, Avison Young, is also an agent on the Martins Bank scheme. Its latest survey says the project is now expected to complete by the end of 2025 but no further details have been forthcoming.

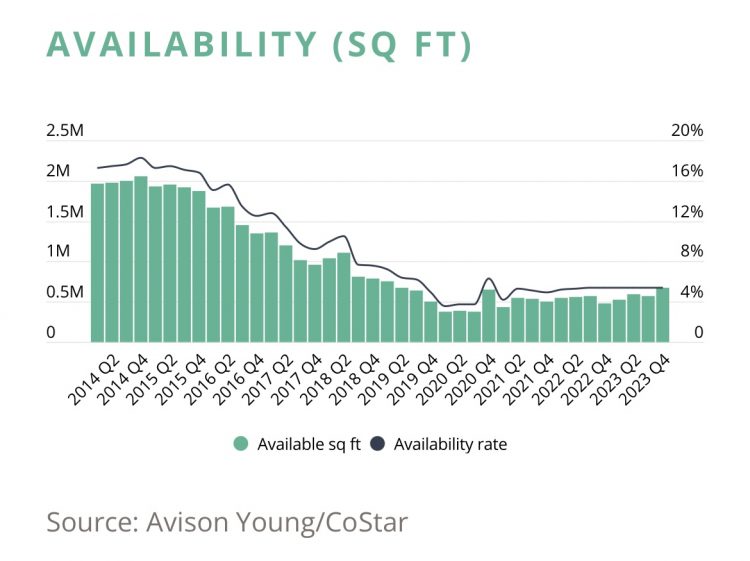

Ten years ago the availability of office space in Liverpool stood at around 2m sq ft. Since 2020 it has been hovering at around 500,000 sq ft.

The Big Nine report says: “The availability rate remained (in the final quarter of 2023) at 5.4% but premium quality space is severely undersupplied, with the grade A availability rate at 0.1%.”

While it is true to say the pandemic is still having an effect on demand for office space in CBDs, Avison Young reports that the “return to the office” had stabilised over 2023. Demand for space is still there but Liverpool is struggling to meet it.

Major schemes such as Pall Mall, which stalled when a pre-let to BT fell through, and a new office development at Princes Dock, have long been touted but shovels in the ground still seem some way off.

New office space is available elsewhere in the city. In the Knowledge Quarter The Spine is now filling up and plans for two more commercial buildings – HEMISPHERE 1 and 2 – are in the pipeline. Although they are heavily focused on the life sciences sectors.

And just across the river in Birkenhead, almost 78,000 sq ft of grade A office space has come onto the market in the town centre.

In October, Wirral Growth Company, a 50:50 partnership between Wirral Council and developer Muse, took control of two new office buildings – Mallory and Irvine – totalling around 150,000 sq ft and costing £75m.

Wirral Council will occupy all but one floor of Mallory, taking almost 59,000 sq ft. The remaining floor comprises 19,654 sq ft. Just a few minutes train ride from Liverpool CBD, this scheme currently offering something that Liverpool is struggling to provide.