Where next for Liverpool city region’s industrial property market?

Jonathan Lowe at the Liverpool office of property consultancy Avison Young looks at how we address shortages in the industrial property pipeline

The shifting nature of the Liverpool city region economy has left industrial property marginalised and facing new challenges as growth continues to focus on leisure, culture and digital technologies.

As the city region’s new economy continues to grow, areas historically established as locations for small-scale industrial use, are fast disappearing and being converted to new uses.

Change of use

Areas of Liverpool such as Brunswick Dock, the Ropewalks and Baltic were among the first to see this type of change, where residential and leisure development in particular, began to replace buildings traditionally used as industrial and manufacturing spaces.

Of course, this all has its benefits and has contributed to boosting leisure economies, as well as providing dedicated and interesting spaces for the flourishing digital and creative sector to grow.

However, that change of use, coupled with a clear focus from developers on the industrial “mid box” market, 25,000 to 150,000 sq ft, within the Liverpool city region, has resulted in a distinct undersupply of existing sub 15,000 sq ft units, without a committed pipeline of supply for new builds coming through.

Critical shortage

A lot has been said on the subject of Liverpool’s shortage of grade A office space in the city centre, but the supply of quality industrial space for SMEs across the city region is now also critically low.

While there are a number of vacant industrial units on the market at present, there are few available below 15,000 sq ft that are either modern or newly refurbished. The majority of modern industrial occupiers demand clean, presentable new or recently refurbished space, and they are prepared to pay for it, when compared with cheaper dilapidated space on run down estates.

Looking at other areas on the periphery of the city centre which are currently mainly industrial, we can see the beginnings of the same process of a de-industrialisation of property stock happening again in other more central areas.

New vision

The Ten Streets scheme to the north of Liverpool city centre is being promoted by the city as a new hub for creative and digital companies, eventually, it is hoped, employing 2,500 people.

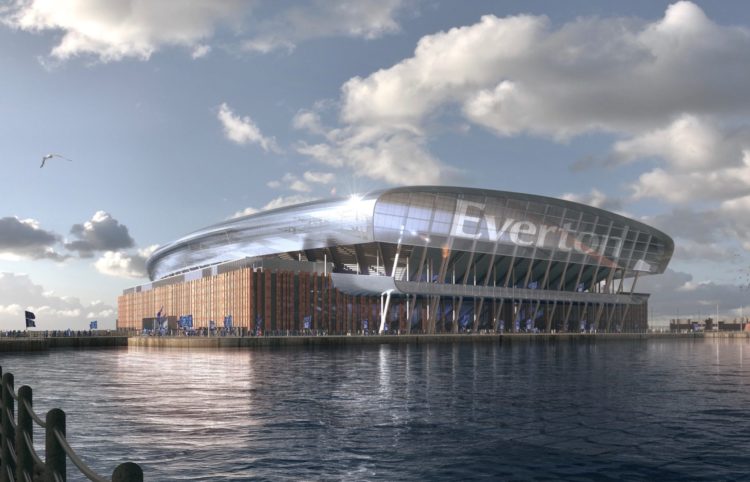

The vision, which is captured in the city’s Spatial Regeneration Framework (SRF) document, is already moving forward and will receive a major boost should other high-profile schemes such as Everton Football Club’s proposals for a new stadium at Bramley-Moore Dock be delivered.

Everton’s stadium development, along with other key elements of Liverpool Waters, will change the face of this part of the city and, in all likelihood, further diminish the availability of small-scale industrial premises.

We don’t necessarily expect people to shed too many tears over these losses, but alongside the city centre’s northward expansion through Pumpfields, Ten Streets and the waterfront generally, there needs to be a plan for the city region to retain the jobs and create opportunities for smaller more industrial-led businesses which are likely to be displaced through growing land values and new phases of development.

Market gap

There is an opportunity for the city region is to take advantage of the national market gap in this smaller development size bracket for either brand new or high-standard refurbished properties. However, the reduction of availability of grant funding available to developers, coupled with the rising construction costs and land values (and availability), limits viability in certain areas.

Any response though will undoubtedly be market-led, and the direction of travel suggests that it will be areas of south Sefton, Wirral and Halton which stand to benefit the most.

There are fantastic opportunities in this sector for developers and landlords and these should become more appealing as development opportunities continue to be shifted from the city fringe to more out-lying areas of the city region.